Your angle or yuor devil: choosing between LLC and nonprofit

Ms Boba's Quarterly Extravaganza #2 part 2

Warning: Almost There but Not Quite

The post you're about to read is marked as pre-beta! While the content should be overall accurate and understandable, it was not reviewed for flow, imprecisions, typos, or accidentally-abandoned sentences.

Venturing through? Let me know your thoughts!

Table of Contents

OwO What’s this?

This is a commented version of the second edition of my $upporters newsletter/town hall/“quarterly extravaganza” (or, better said, of one of its sections). It was originally published in January 2024, and it’s now public. If you want new editions of this Town Hall straight into your inbox as soon as they’re available, you can support me on Patreon or on this same website!

Warning: Missing Feature!

You cannot enlarge images on this blog yet (alas). Do make generous use of

“open image in new tab” on browsers, “pan to zoom” on mobile, or ignore the small

text and focus on the–literal!–big picture.

Town Hall 2 part 2: We (mostly) figured out the legal stuff

Since the dawn of the BobaVerse project, I had one question in the back of my mind: in the long term, should these projects be under a nonprofit or a more typical business structure?

For a long while, this question stayed unanswered. Then, after FujoGuide’s very succesful Kickstarter campaign showed us we were “in for the long run”, it became time to finally answer it.

The challenges were many: for one, I had never worked with lawyers before (not even in my home country); then, as the lawyers themselves said, “the legal system is 20 years behind the type of project you’re trying to build”; last, (in case you’re not aware) lawyers are really expensive.

However, with grit, determination, and lots and lots of reading, we eventually made a choice.

Here’s what we learned.

Nonprofits vs LLCs

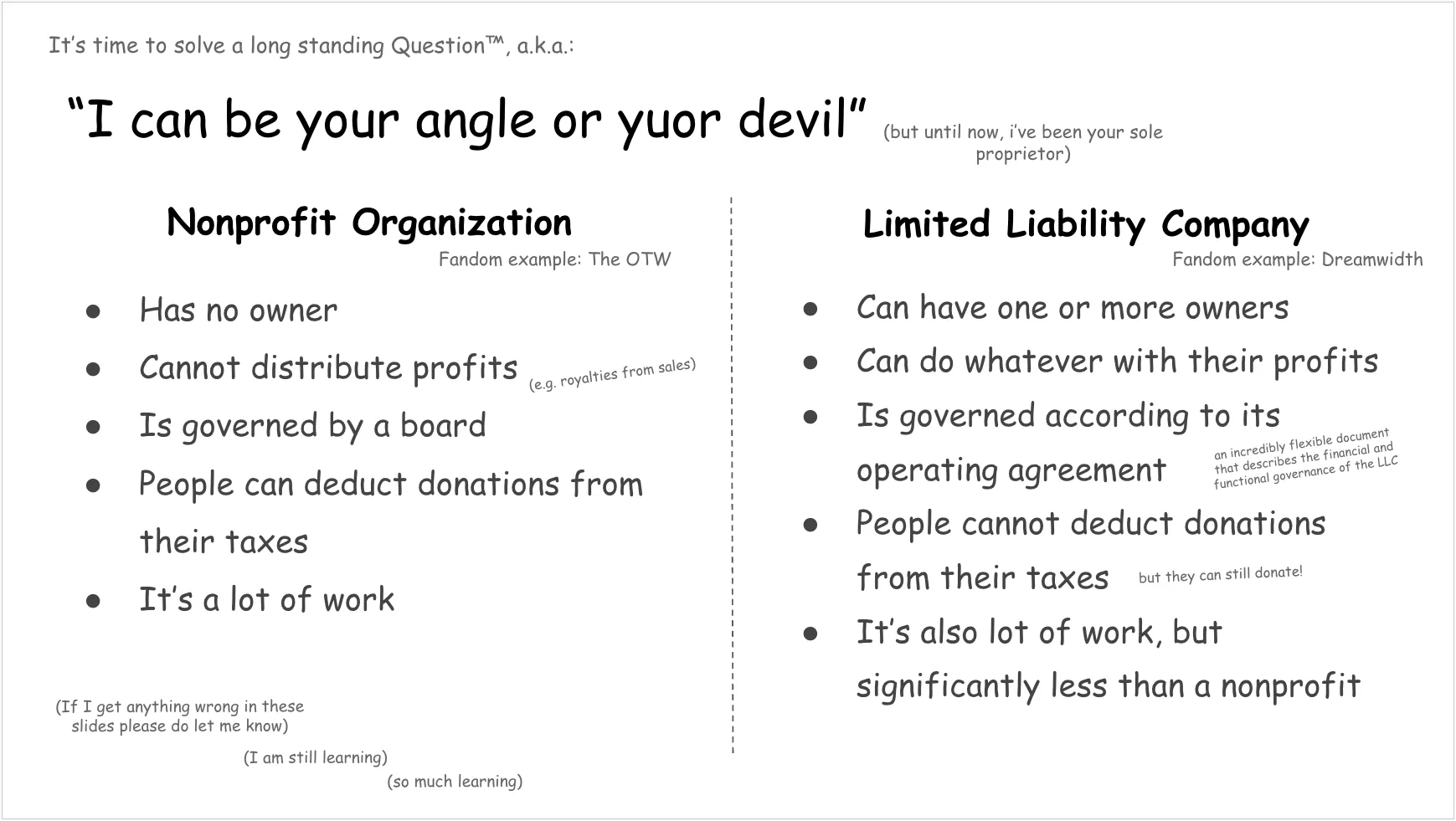

The first step in this journey was to look at the path chosen by other fandom-adjacent entities. As people might know, Archive of Our Own (the largest fanfic archive, popularly known as AO3) is headed by The Organization for Transformative Works, a nonprofit organization dedicated to the preservation of fanworks. Conversely, Dreamwidth (a social network for fandom born on the wings of Strikethrough) went with an LLC, thus choosing the for profit route.

Being unable to copy our foreparent’s homework (an unwise choice regardless), the next task became clear: we collected information on the difference between nonprofit organizations and LLCs to help us determine which one would better fit our needs.

On the other side of this work, the difference feels straightforward. However, getting a clear picture of the legal intricacies felt way more overwhelming when learning about it all. This is just an abridged version of them!

Fun fact: we were sure we’d make the opposite choice until the almost-very-last minute. One day, you’ll hear all about what we’d do if we had the resources to choose both (maybe one day we will).

Choosing a Winner

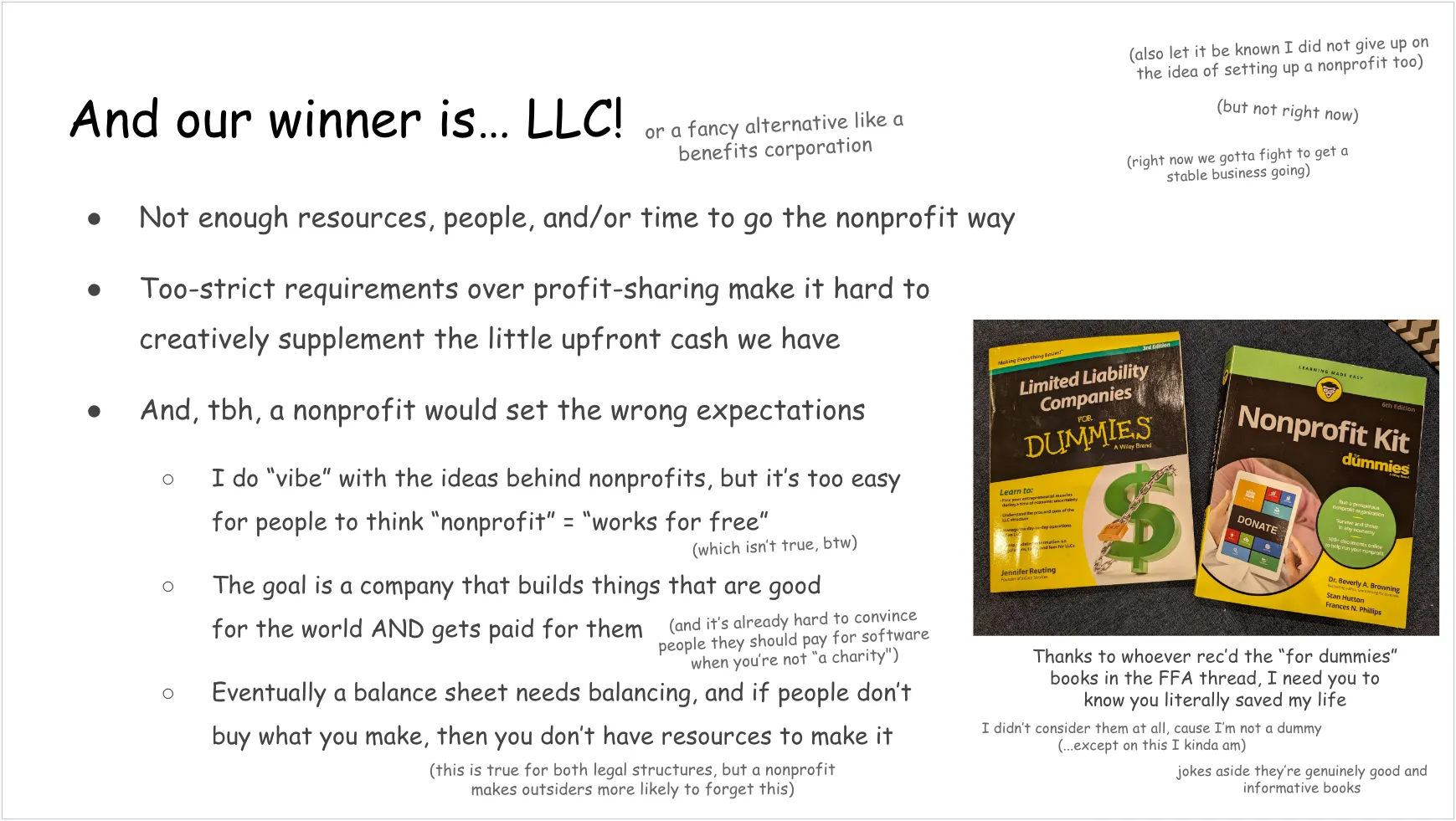

As the slide below says in big, bold letters, we chose to incorporate* as an LLC (and, once we grow enough, possibly switch to a benefits corporation1). This was not an easy choice, and we went back and forth–and agonized over it–for quite a while. Eventually, however, a few considerations tipped the scales:

- While our projects have a “charitable intent” that would allow us to qualify for 501c3 status (a.k.a. become a nonprofit), we decided that the procedures required would place a too heavy weight on our already-stretched shoulders.

- As we spearhead many ambitious projects with very little budget, we wanted to be able to reward those who took a bet on us with their time and work, should our efforts eventually pay off.

- Last–without mincing words–the online (and fandom) discourse around and view of nonprofits made us uncomfortable: while it’s true that nonprofits have a charitable intent, they still have a balance sheet to balance, and produce work that deserves to be paid for. This seemed too easy to forget.

* As of January 2024, we’re not yet officially a company. We’re working on it, and you’ll hear more as the year progresses!

The ethical concerns

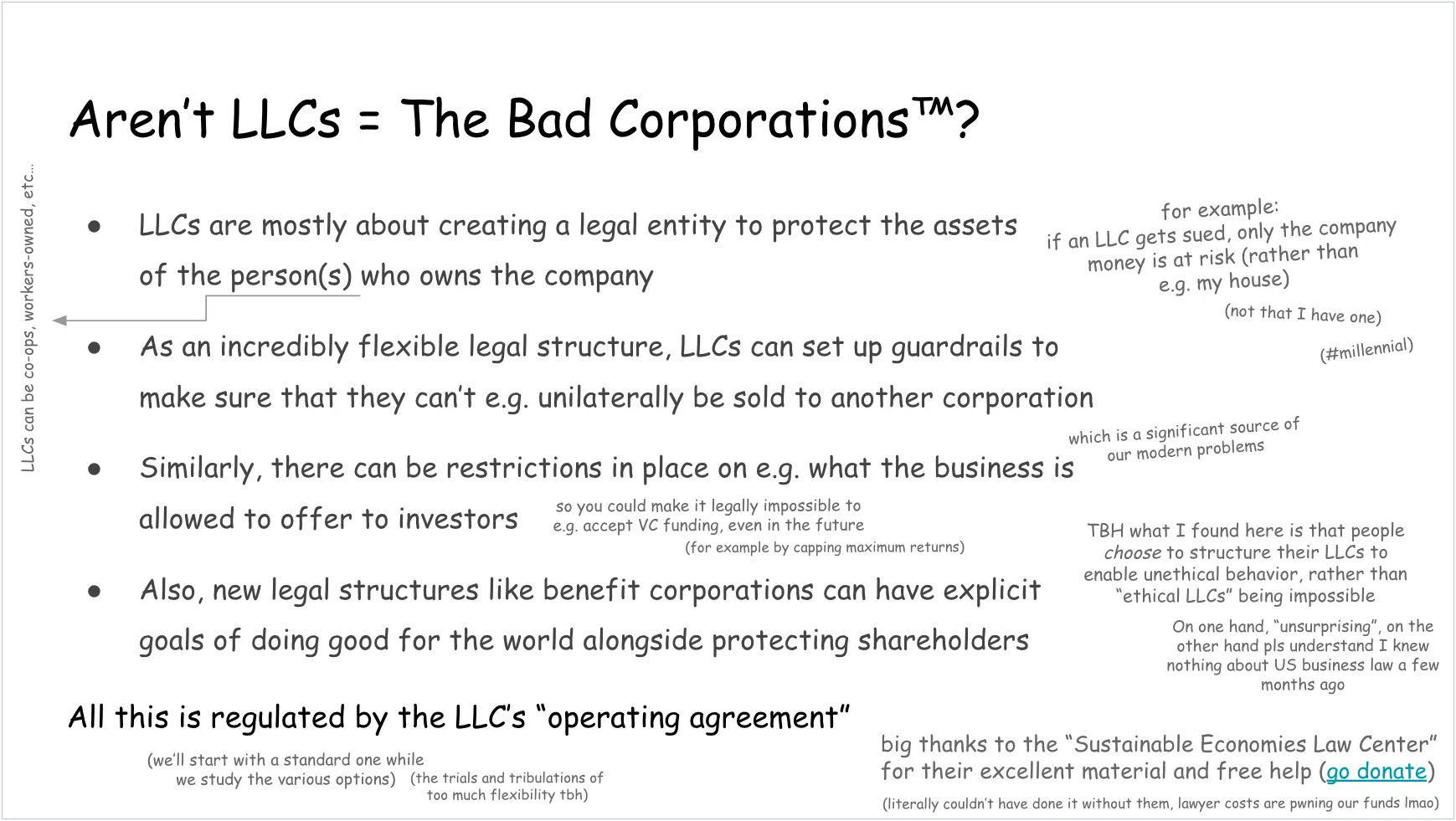

Given that our projects have a clear “anti-corporate bent”, becoming a for profit corporation came with concerns. As we researched more, however, we found that LLCs are an incredibly-flexible legal structure that gives us ample power to add ethical guardrails. Indeed, by adding to their Operating Agreements (the governing document of an LLCs), the members of an LLC can ensure the company is run (and remains run!) in a way that’s consistent with their values.

The scope of available options for a custom operating agreement (and, most importantly, their consequences) is a deep rabbit hole we haven’t fully dived into yet. Among the possibilities we learned about is putting a legal upper limit on the amount of returns that can be offered to investors (thus discouraging or outright forbidding Venture Capital investments); ban the company from being sold to corporate entities; or become a cooperative managed by its members, or even a custom type of management structure that better meets the needs and wishes of our collaborators.

Until we have more resources in place and a better understanding of our future, we’re going to keep things simple: at first, our LLC will be what’s called a “single-member LLC”, owned by yours truly (me). As our work continues and enjoys more and more stability (and more funds for lawyers), we’ll be looking into how we can better distribute both success and responsibilites, as well as how to formalize and incorporate our ethical principles.

In the meantime, if you know a lawyer who loves infodumping about corporate (or other) law (especially on Discord), please send them my way. Our legal journey has just started, and it’s only going to get more complex from here on out.

While I condensed it in just 3 slides, this research has taken a lot of time, effort, and money. Lawyers are a significant expense. We really, truly wouldn’t have been able to get here without the pro-bono help of the amazing “Sustainable Economies Law Center”, whose lawyers provided incredible advice and fielded many disparate questions. You can donate to them here.

For-profit motives and social networks: BobaBoard’s destiny

If you asked me about the corporate structure of BobaBoard in the past, you’ve undoubtely heard my rant on the incompatibility of for-profit motives, and sustainable, community-driven social networks. While this might make the choice of going with an LLC appear puzzling, I want to assure you: my opinion on the topic has not changed.

While we’ll move many of the projects in the

BobaFujoVerse under the new legal entity,

BobaBoard will stay behind as an independent project. We’re currently

looking into fiscal hosting as a

lightweight option to grant it nonprofit status, without adding an unsustainable

administrative burden. Once again, you’ll hear more as the year progresses.

Next Up: More Extravaganzas

If you’ve enjoyed the content in this article, there’s way more where that came from! Subscribe to my Patreon or my self-hosted newsletter and enjoy exclusive, early-access to this content and beyond!

Footnotes

-

A benefits corporation is a new type of legal structure that sits in-between nonprofits and other corporate structures like LLCs. A benefits corporation must include a social benefits cause in its mission statement, and must consider the social impact of its business choices, rather than just the economic impact for its shareholders. While complications with taxes and processes make it an unwise choice to start with, we’ll continue evaluating the possibility with time. ↩